Boise State’s College of Business and Economics is known for its strong community connections – from the Idaho Small Business Development Center that offers free business consulting to TechHelp that provides manufacturing services for Idaho companies. That strong community connection also extends to individual Idahoans.

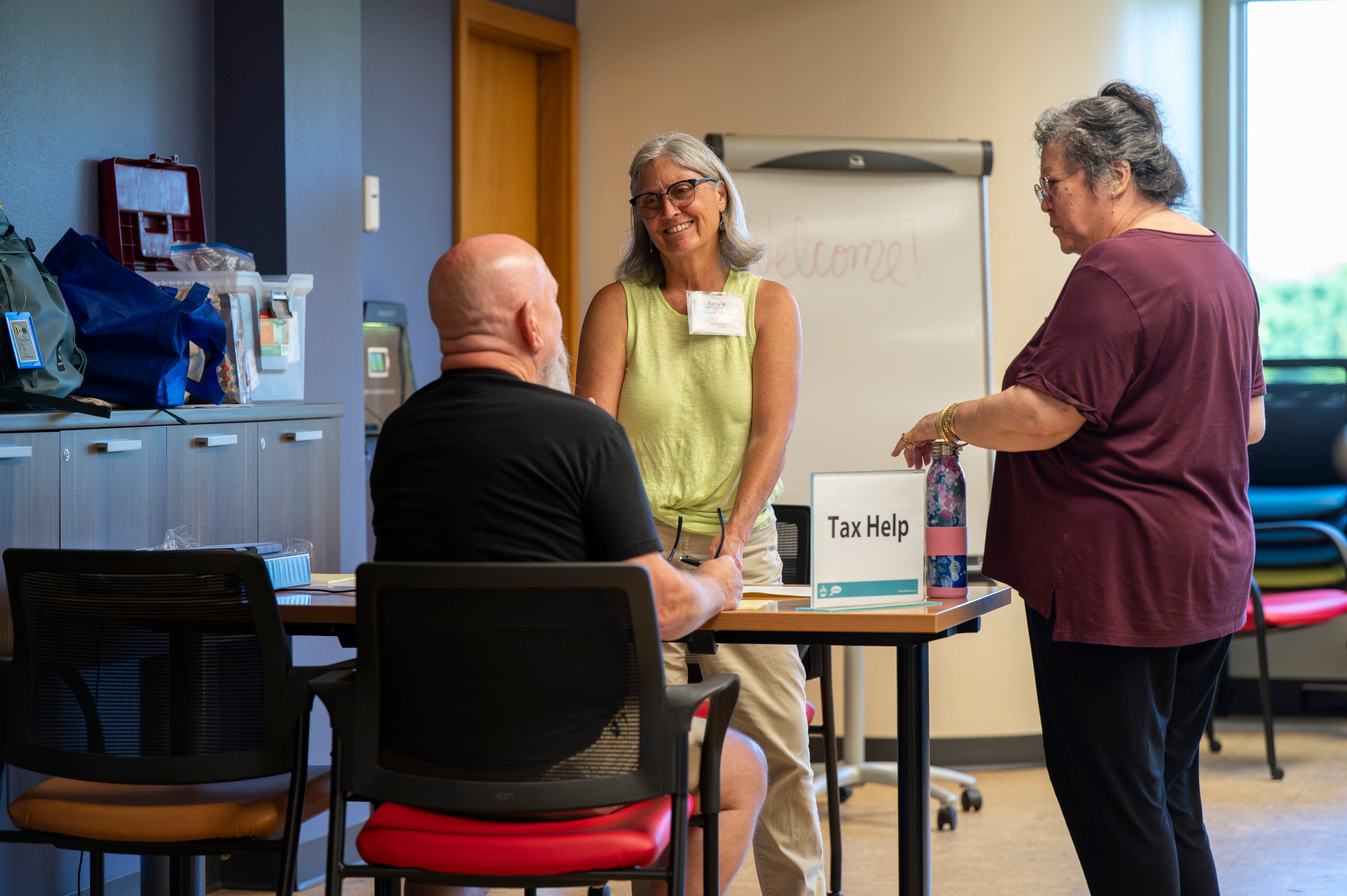

The college’s Department of Accountancy operates a Volunteer Income Tax Assistance program (more familiar to some as VITA) in which IRS-certified tax preparers – many of them students – help clients prepare their tax returns free of charge. The program closes a gap in access to tax services for low- and moderate-income Idahoans (earning $67,000 or less annually), people with disabilities, the elderly, and those with limited English proficiency.

While taxes and tax form prep may sound like dry subjects at the outset, each tax return represents a life story, said Kathy Hurley, a lecturer in accountancy and the program’s site coordinator. She recalled a family that sought assistance some years ago, newly arrived from Afghanistan. This year, the father graduated with his MBA. “All of the stories are incredible,” Hurley said.

A thousand tax returns, a thousand stories

Tax preparers receive thorough training before working on returns. Preparers include undergraduate and graduate students, the majority from the accountancy program. Students can receive one-time credit for their work through the course Accountancy 485/585 – Volunteer Income Tax Assistance (VITA) Program. Additional students share their talents on a purely voluntary basis, Hurley said. That includes members of Beta Alpha Psi, the accounting, finance and information technology management honor society for which Hurley is faculty advisor.

“What’s most important is that our preparers go through training, and they are never alone,” Hurley said. Every return has a preparer and quality reviewer.

Community members also volunteer as preparers. Their ranks include a retired engineer, current and soon-to-be lawyers, retired accountants, a software engineer, and a volunteer who retired from the military.

“This work exposes us to people’s life experiences very different from our own. Unlike the stereotype, we’re not sitting in a corner with our glasses on, tracking numbers,” Hurley said. “Accountancy is a people business.” That involves talking with clients who range from retirees with decent incomes to social security recipients living on less than $12,000 a year, to unemployed single parents. “You have everything,” Hurley said. “I worked with one family of new Americans who had W-2s from 10 different jobs.”

Aside from the obvious benefit to the community, the free tax program hones students’ communication skills and lets them practice what they’re learning in the classroom. “A textbook can say one thing, but it might not tell you how to figure out filing status when three families are living in one household, a parent is supporting a stepchild, or a child who is not their own. We find the answers. This is an incredible learning experience,” Hurley said. “And it’s fun.”

The program receives support from the university and through grants from the IRS. The International Rescue Committee in Boise and Boise Community Schools provides client prescreening, interpreters and tax preparation space.

An accountancy student finds her niche

Student Stephanie Otto didn’t know she’d find joy in taxes, but she has. Taking Accountancy 485 and working as a tax return preparer became defining academic experiences for the senior accountancy major from Meridian, Idaho.

“I just found it all really fun,” she said. “There’s this set of black-and-white rules, but every client has a different story. It’s like a weird puzzle you have to figure out, fitting income and expenses into the right boxes.”

What surprised Otto most wasn’t the tax code’s complexity but the warmth of the clients she worked with. One encounter, in particular, stuck with her: helping a woman at the senior center in Kuna. “She gave me a hug when I finished her return and said, ‘I’ve never had so much fun doing my taxes.’ I’ve been surprised by how many hugs — and chocolates — I’ve gotten.”

That sense of human connection helped Otto grow more comfortable in the role of tax preparer. “I’m not very social, honestly,” she said with a laugh. “But being in this class forced me to talk to people. And I made good friends through the program.”

Otto also sharpened her detective skills. One client came in confused, saying she’d owed $1,800 the previous year and nothing this year, even though her income hadn’t changed. “I dug into the documents, realized something was off, and we ended up doing an amended return,” Otto said. “The client got about half her money back. It was such a good feeling. This is why communication matters.”

Otto had initially planned to become a certified public accountant immediately, but she’s decided to apply to the Master of Accountancy – Taxation program at Boise State. “Tax gives me a purpose,” she said. “It’s not just about numbers—it’s about financial literacy, family, even small business decisions.”

By the numbers

- In 2025, the Volunteer Income Tax Assistance program had 1,045 federal tax returns accepted (up from 890 in 2023) and helped over 1,200 Idahoans.

- 35% of patrons were aged 60 or older

- 12% had limited English proficiency

- 6% were veterans

- 14% were disabled

- 18% were self-reported as non-white

- 34% were self-reported as Latino/Hispanic

- 20% were refugees or new immigrants

- Boise State’s program has four regular sites: on campus in the Micron Business and Economics Building, at Boise Public Library, the Meridian Library District, and at the International Rescue Committee. In 2025, volunteers also worked with patrons in senior centers in Kuna and McCall. Approximately 80 volunteers work with the program each year, half as greeters, facilitators and interpreters, half as certified tax preparers.

- The average refund for returns is $1,937, with 558 clients receiving refunds.